Decentralized Autonomous Organizations (DAOs) for NFT Projects

Decentralized Autonomous Organizations represent a fundamental shift in how creative projects organize and govern themselves. For NFT collections, DAOs offer more than just a trendy governance model—they provide practical frameworks for sustainable growth, community engagement, and collaborative decision-making. As collectors increasingly seek deeper involvement with their digital assets, DAOs have emerged as powerful vehicles for transforming passive holders into active participants.

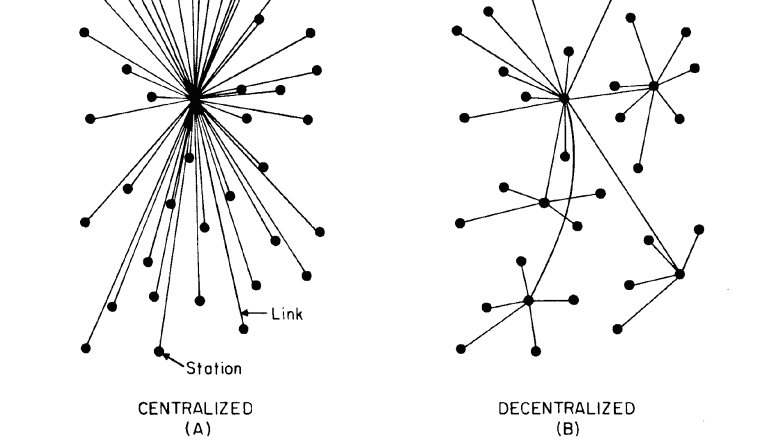

The intersection of DAOs and NFT projects has created vibrant ecosystems where tokenholders shape development roadmaps, manage community treasuries, and collectively determine brand direction. This approach stands in stark contrast to traditional centralized models where a small team makes all decisions, often without transparency or community input.

Structural Foundations of NFT DAOs

NFT DAOs typically operate through specialized governance structures optimized for creative decisions. Unlike financial DAOs focused primarily on protocol parameters, NFT DAOs must balance artistic vision with commercial viability and community wishes.

Most successful NFT DAOs implement multitier voting systems where holding specific NFTs grants governance rights. These rights often scale with rarity or quantity of holdings, allowing for weighted influence based on investment level. The governance tokens may be separate from the NFTs themselves or intrinsically linked to specific NFT holdings.

Proposals in these organizations range from simple directional votes to complex treasury allocations for development, marketing, or acquiring other digital assets. The technical infrastructure supporting these governance mechanisms typically includes dedicated platforms like Snapshot or custom-built solutions integrated directly into project websites.

Treasury Management and Value Creation

One of the most compelling aspects of NFT DAOs involves collective treasury management. Initial NFT sales often generate substantial capital that, when directed through DAO governance, can fuel ongoing development and value creation.

Sophisticated NFT DAOs employ multi-signature wallets requiring approval from several designated members before transactions execute. This approach balances security with operational flexibility while maintaining transparency. Community members can track treasury movements on-chain, creating accountability rarely seen in traditional organizational structures.

Strategic treasury deployment by successful NFT DAOs includes funding technical development, commissioning additional artwork, securing strategic partnerships, and even acquiring other valuable NFTs or digital assets. Some forward-thinking DAOs have established grants programs that fund ecosystem extensions by independent developers or artists.

For NFT collectors, these community-managed treasuries represent potential long-term value beyond the initial artwork purchase. As the treasury grows through royalties and strategic investments, each governance token potentially appreciates in value.

Community Cultivation Through Collective Ownership

The psychological impact of DAO structures on NFT communities cannot be overstated. When collectors transition from passive owners to active stakeholders, engagement levels transform dramatically. Decision-making rights create stronger bonds between participants and foster genuine community around shared goals.

This dynamic has proven particularly valuable for maintaining momentum after initial NFT drops. Rather than excitement fading after mint, DAO structures create ongoing touchpoints for engagement through proposal discussions, voting events, and collaborative execution of community decisions.

As we’ve discussed extensively on the NFT Marketo blog, community remains the critical success factor for NFT projects in today’s competitive landscape. The DAO model provides structural reinforcement for community cohesion through aligned incentives and shared governance.

Implementation Challenges and Solutions

While conceptually straightforward, implementing effective DAO structures for NFT projects presents significant challenges. Voting mechanisms must balance accessibility with security, while proposal systems need safeguards against both spam and malicious takeover attempts.

Successful NFT DAOs typically start with limited governance scope that expands as the community demonstrates coordination capability. This graduated approach allows governance to mature organically rather than overwhelming participants with complex decisions before establishing operational norms.

Technical barriers have diminished substantially with the emergence of specialized tools from organizations like Aragon. These platforms provide modular components for DAO creation, allowing NFT projects to implement governance without extensive blockchain development experience.

Legal considerations remain complex for NFT DAOs, with regulatory frameworks still evolving in most jurisdictions. Many projects operate through dual structures—a traditional legal entity for contractual matters alongside the decentralized governance system for community decisions.

Case Studies in NFT DAO Innovation

Several pioneering projects have demonstrated the potential of DAO governance in the NFT space. Nouns DAO, with its daily NFT auctions feeding a community treasury, has shown how sustainable funding models can power ongoing creativity and development. Their one-NFT-per-day model creates continuous engagement while building substantial resources for community allocation.

The collector DAO model, exemplified by organizations like FlamingoDAO, takes a different approach by pooling resources to acquire significant NFTs that individual members couldn’t access independently. These collection DAOs demonstrate how collective action can strengthen market positions while distributing both risk and upside.

Metaverse-focused NFT projects have used DAOs to govern virtual land development, establishing democratic processes for determining construction priorities, aesthetic guidelines, and space allocation. This approach has proven particularly valuable for maintaining consistent experiences across decentralized virtual environments.

Future Trajectories for NFT DAOs

The evolution of NFT DAOs continues to accelerate as projects experiment with innovative governance models. The future likely includes more sophisticated reputation systems that weight influence based on factors beyond simple token holdings—potentially including participation history, contribution value, and domain expertise.

Integration between NFT DAOs and physical assets represents another frontier, with some organizations already purchasing real estate, funding physical art installations, or establishing popup experiences coordinated through decentralized governance.

Cross-DAO collaboration frameworks are beginning to emerge, allowing distinct communities to coordinate on shared objectives while maintaining independent governance. These meta-DAO structures may eventually create powerful ecosystem effects across previously disconnected NFT communities.

Conclusion

Decentralized Autonomous Organizations have transformed governance possibilities for NFT projects, creating authentic avenues for community participation while establishing sustainable operational models. As the technology matures and legal frameworks evolve, DAOs will likely become the default governance structure for serious NFT collections with long-term aspirations.

The most successful projects will balance decentralization ideals with practical execution capabilities, creating governance systems that enhance rather than hinder creative development. For collectors and creators alike, understanding DAO mechanics has become essential knowledge for navigating the evolving NFT landscape.